With the public declaration by the Ministry of Finance (MoF) of the United Arab Emirates (UAE) that a new federal corporate tax (CT) system would be implemented across the nation. Under which applicable companies must submit mandated corporate tax audit in UAE. The system will be in place for fiscal years beginning on or after June 1, 2023.

Following similar actions in adjacent Gulf states like Bahrain implementing corporate tax for exploration and hydrocarbon firms, the UAE is taking this action to comply with international tax requirements while reducing the financial strain of complying with UAE businesses and protecting start-ups and small enterprises. The UAE, which is home to Dubai, a major global financial center, will continue to have among the lowest corporate tax rates worldwide!

What is Corporate Tax Audit in UAE?

A corporate Tax Audit in UAE is a mandatory process to audit the tax liability, Tax compliance and financial records of companies that meet the conditions. An auditor reviews the financial statements, tax returns, and documents to identify any discrepancies or errors during the process.

In order for the governing body to determine whether a taxable organization is adhering to the corporate tax law and standards as per FTA guidelines, corporate tax audits are carried out and submitted to the government. It is mandatory for all companies to adhere to this Corporate Tax Law and Audit procedures.

The FTA investigates if the taxable companies have settled all debts and that all taxes are due to have been collected and paid to the authorities within the time limit specified through the tax audit.

Who needs Corporate Tax Audit in UAE?

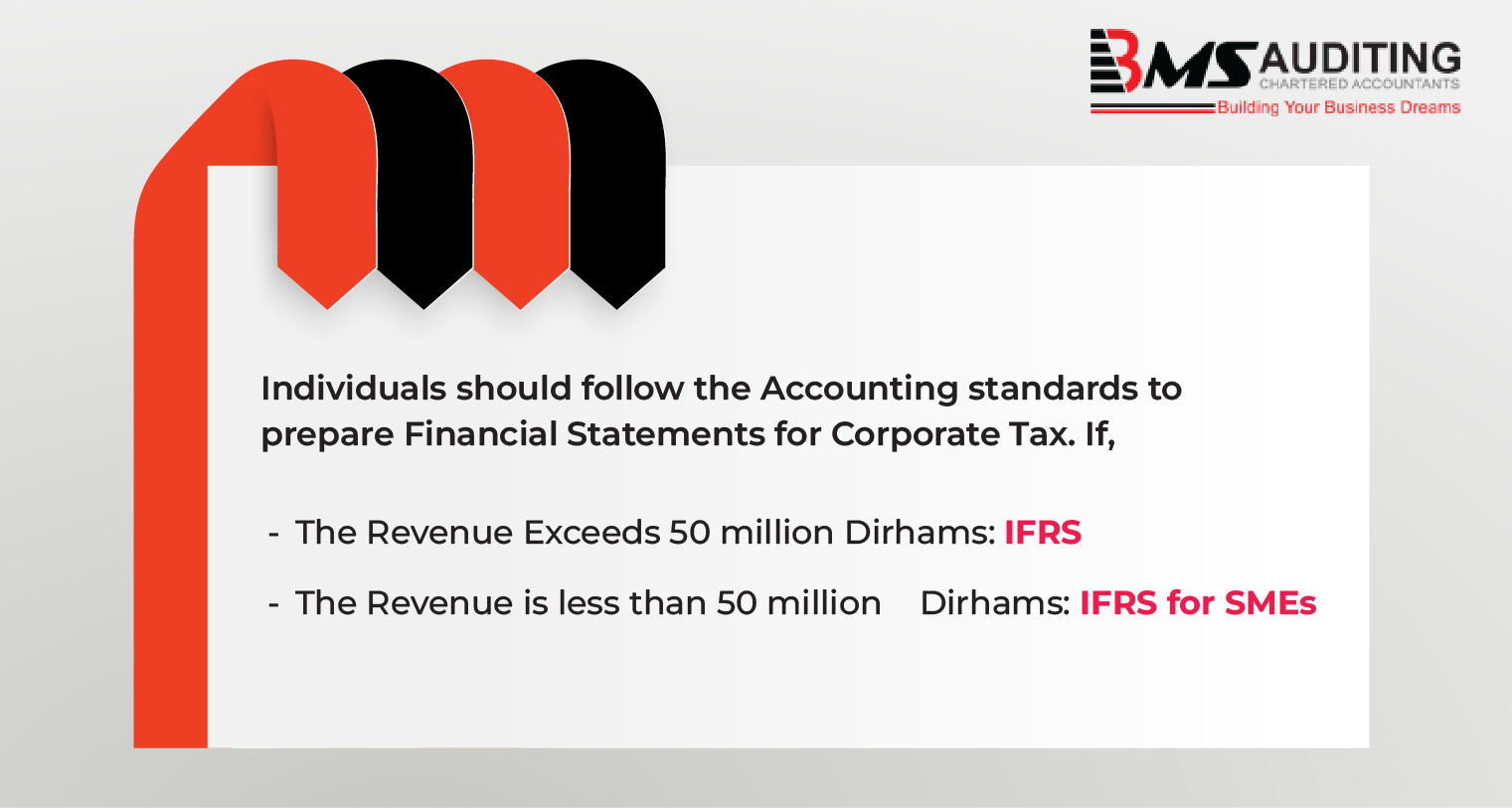

According to the Ministerial Decision No.82 of 2023, Applicable Taxable Persons should Prepare and Maintain Audited Financial Statements for corporate tax if it meets certain requirements below:

- A Taxable Person earning Revenue exceeding AED 50,000,000 (fifty million UAE dirhams) during the relevant Tax Period.

- A Qualifying Free Zone Person.

It's crucial to remember UAE's corporate tax audits are not performed at random but instead in accordance with the previously mentioned criteria. To prevent the possibility of fines or penalties related to a tax audit, businesses should ensure they comply with every tax regulation and law.

Condition to prepare Audited Financial Statement for Corporate Tax

The Qualifying Free Zone Persons also will be obliged to follow IFRS Accounting Standards in Dubai to prepare Financial Statements for Corporate Tax UAE.

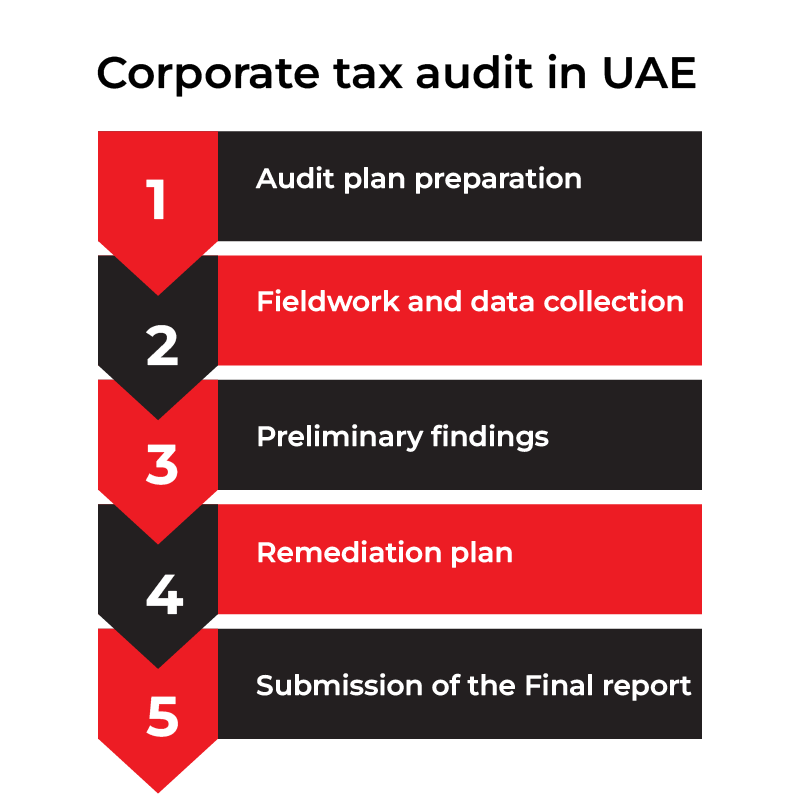

Corporate Tax Audit Procedure in UAE

Companies can ensure FTA compliance in the UAE and get ready for a Corporate tax audit by taking the necessary actions:

Step 1: Without any particular reason for doing so, the FTA officials will examine the company's corporate tax returns and other information.

Step 2: The auditor(s) will have a meeting with the company at the appointed place on the time and date specified to start the audit process.

Step 3: The auditor may request originals or copies of business documents during the corporate tax audit, as well as take samples of the goods and other on-site assets. The party being audited has the right to request the tax auditor's qualifications, such as their expert identification cards, to verify their legitimacy.

Step 4: The authority can mandate a re-audit if anything odd is discovered during the audit that could affect the tax return. The person being audited has the right to ask for a duplicate of the notice and any relevant documents and to attend the auditing procedures that are carried out away from the official locations.

Note: Unless exceptional events demand it to be done outside of normal business hours, the Corporate tax audit will be carried out during FTA's official period of operation. The business being audited for taxes, along with its solicitors and tax advisors, must cooperate fully with the auditors as they carry out their duties.

It is a known fact that only FTA registered Tax agents in UAE or Taxpayers can only register for corporate tax in UAE and file corporate tax returns to comply with UAE CT Law.

Benefits of Corporate Tax Audit in UAE

The purpose of a corporate tax audit is to ensure that companies are paying the correct amount of tax and following the regulations set by the Federal Tax Authority (FTA) in the UAE. Companies that fail to comply with tax regulations may face corporate tax penalties or legal action. Here’s how auditing your documents for corporate tax benefits you:

- An essential tool for locating flaws in an organization's accounting systems and recommending improvements is auditing. Additionally, this procedure assists in informing our partners of any circumstances or topics that might benefit from our counsel.

- In addition, an audit gives directors who are not involved in day-to-day accounting tasks the assurance that the company is operating in accordance with the information it is receiving. This may lessen the opportunity for fraud and dishonest accounting techniques.

- An audit also makes it easier to give advice that can help a business in real ways financially. This includes perceptions of the operation of the company, anticipated margins, and methods for achieving them. The recommendations range from improving internal controls to lowering the risk of scams or tax planning.

- Regular audits can improve the veracity and accuracy of the information provided to potential buyers, which can be especially helpful for owner-managers who intend to sell their company within the next three years. Overall, an audit is a crucial tool for guaranteeing sound financial standing, lowering the risk of fraud, and giving businesses helpful advice.

Corporate tax audit services in UAE

BMS Auditing has the best tax consultants in UAE to offer professional and expert Corporate Tax Services in UAE that also comprises auditing of corporate tax for your business. With unparalleled years of experience for our Tax advisors in VAT and Excise Tax in UAE, we are now well-equipped with FTA Approved corporate tax consultants in UAE to offer the best services on Corporate Tax including,

- Corporate Tax Assessment

- Corporate Tax Registration

- Corporate Tax Audit

- Corporate Tax Return Filing

- Corporate Tax Compliance

On the other hand, our business setup consultants can help you get your documents attested and establish your business in UAE free zones to reduce the corporate tax liability in UAE. Want to know more? Contact BMS Auditing